Read time: 3 mins

Squid Game on Netflix became a cult classic overnight. It was a bloody, violent and cynical commentary on the household debt crisis that is still gripping South Korea, a phenomenon where the total amount of debt owed by individual citizens through loans, mortgages and finance is more than 100% of the country’s GDP.

High levels of household debt is a problem. It was a significant contributor to the 2008 financial crisis. It impacts employment levels, quality of life and economic recovery – especially important when navigating the recovery from a pandemic.

From a human perspective, when times are financially difficult, there is often a surge in gambling and risky, short-term loans. For some, the allure of investing in cryptocurrency and the potential of becoming a millionaire overnight is incredibly compelling.

Squid Game Token

SQUID’s official whitepaper offered a pay-to-play, crypto-based equivalent to the Netflix game. The premise was simple. Users would purchase squid tokens. These purchases would fund a prize pot, with a small percentage going to the developers to cover future partnerships. Players would play through 6 games, as in the series, and the last one standing would win all the money.

Squid Game’s Whitepaper: https://drive.google.com/file/d/1–4MDZ-2lNmh9KpZ0TfosVHkAPCuxD6Y/view

Unlike the series, the crypto game offered uncapped rewards for players. The only limit was the number of players who joined – the more people who put money in, the greater the prize pot at the end. The other key element was that SQUID offered an “innovative anti dump mechanism” to provide users with safety and security as they played through the games in pursuit of riches.

The eloquence of the whitepaper and the confidence in their product roadmap was a clear sign. This crypto coin was going to the moon.

Green Light

Tony buying a SQUID on 28/10/21 would have paid a meagre $0.85 to own his very own SQUID token. Tony likes this and puts in $100. What happened next is a crypto traders dream.

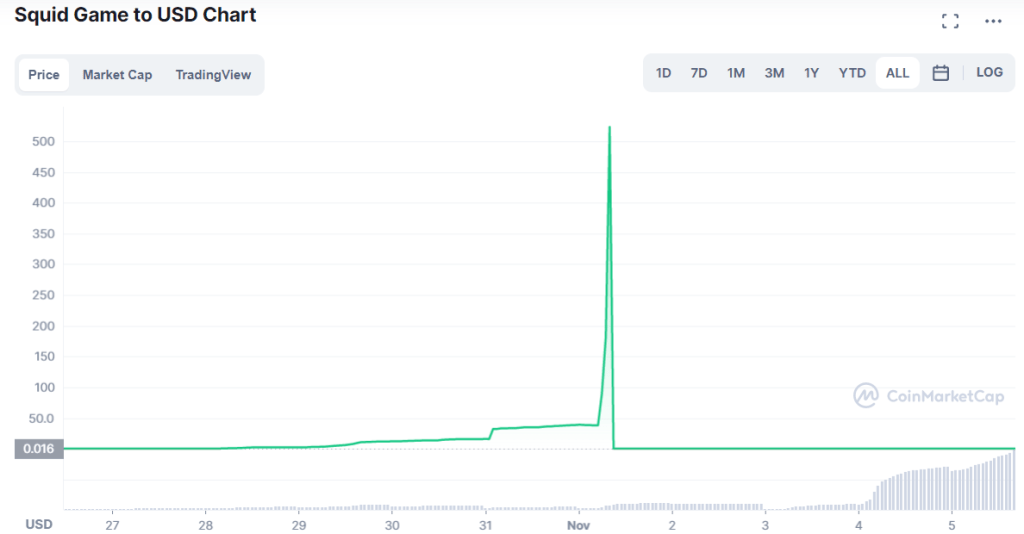

Over the next few days, the SQUID token smashed through the $1, $10 and $100 marks. By 01/11/21, a single SQUID token was worth $2,861. It made the news, being mentioned on the BBC and CNN, further driving the pump.

This meant that Tony’s $100 was worth a quarter of a million dollars. Tony is not an idiot. As any self-respecting trader would agree, when a return like that hits you in the face, it’s time to sell.

However, that’s not what happened. For millions of users who hadn’t read the small print, their efforts to sell were completely in vain. SQUID’s “innovative anti-dump mechanism” essentially meant that no one could sell their tokens. A total of $3.36 million was now locked into SQUID tokens.

What happened next, known as a “rug-pull”, was shocking. It was captured live by twitch streamer Hasanabi:

Within the space of a second, the value of SQUID dropped completely, from over $2.8K to $0.003. The creators of the project had changed the code, allowing them to sell all of their reserves in one go. They walked away with close to $3.36m in the end. And Tony was left with nothing.

Red Light

On closer inspection, it should have been no surprise that this was a scam. The whitepaper is 17 pages long and is fairly clear about the outcome for users who invest in SQUID. “Your experience will only reflect on the… sorrow of losing money when the game failed [sic]” it states.

Their innovative anti-dumping mechanism, it explains, requires users to purchase “$Marbles”. These were a pay to play elements that were significantly more expensive than the SQUID token itself. “$Marbles” were required in order to be able to free trade SQUID – the implication being that those without “$Marbles” would not be able to trade freely and realise their returns.

Their roadmap is impressive in its audacity, seeking to launch all 6 games, release the token to all top crypto exchanges and start a “powerful marketing campaign” in 60 days. Anyone who has been near an IT project knows that this is insane.

Basic Tenants

Naturally, there are risks associated with the entire crypto market. Not only is there the volatility to consider, but there are some commentators who liken the excitement to the dot-com bubble in the 90s. Similarly, they suggest that the whole market could see a similar trajectory. The other thing to consider is where the utility of blockchain technology will settle. Entire segments of the market could disappear as different uses evolve or become more regulated.

That said, there is still a lot of potential in this nascent industry. With some common sense and some insight, it is possible to realise great returns.

Here are some key tips that can help when exploring new crypto coins:

- Be wary of the Binance SmartChain: it’s incredibly easy to create a token on this chain. SQUID ran on this chain. It provides a very low barrier for entry where anyone can anonymously create their own token in a matter of hours. It’s worth looking for coins that are part of their own large and transparent ecosystem, with thriving communities and a proven track record of development. Coins such as DOT and LUNA fit this model.

- Avoid coins based on pop culture or zeitgeist: there will always be products that are developed to piggyback on hype. At best, they will be built in basic technology that doesn’t offer much in terms of differentiation. At worst, like SQUID, they will be outright scams. That said, there have been some great gains from these types of tokens. FC Barcelona released their own tokens which soared in price before dumping. However, the real value of crypto lies in the technology itself and the technology stack developed behind it.

- Check the quality of the documentation: the quality of the documentation and content is important. A cursory glance at the SQUID whitepaper should have sent everyone running for the hills. In many cases, developers will have a community site such as a Discord. This will give an idea of the cadence and frequency of development. These tools should provide some great insight into the development curve and health of any given crypto asset.

- Finally, and most importantly, only invest what you are prepared to lose.

This is part 2 of a series looking at the rise of crypto currency technology for beginners.

One thought on “Part 2: Crypto Tricks”