Read Time: 8 mins

Buy Dogecoin. Actually don’t, buy Bitcoin. No, don’t do that either. Wait, actually, buy both. Questionable excitement and advice from friends, mixed with attention grabbing headlines have left a lot of people scratching their heads. What is crypto? Why should I care?

Like any new thing, the sensible and fact based information is often drowned out by the sheer tonnage of blogs, YouTube videos and articles, most of which are technical, dull and most of all, confusing.

This series will look at different elements for crypto and its underlying technology which is known as blockchain. It aims to provide a general overview of crypto, what it is and some of the people you might encounter talking about it. Needless to say, nothing you read on my blog (or indeed any blog) constitutes financial advice.

What is blockchain?

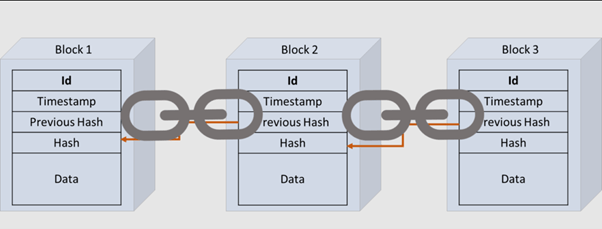

In its most simple form, blockchain is a timeline baked into code. Each “chain” is made up of a string of code. Each “block” is a piece of that code that refers to a specific transaction in time. Each line of transactions or “chain” of “blocks” are unique. They are attributable to a single thing at a single time. A token can be a virtual asset, like a virtual coin (known as cryptocurrency) or attached to a physical asset, like music or a digital asset whereby the blockchain acts as an infinite receipt for everyone who has bought and sold or traded the item or token or coin or whatever it may be.

The second key component of blockchain is that its decentralised. There is no central bank looking after Bitcoin, no dusty old book in the high offices of a financial authority that can dictate who owes who or can change things like interest rates. There’s no Mint who can make more crypto coins (for the most part – there are some “scam coins” which can produce as many coins as they like) and there isn’t massive spreadsheet where some pasty teen can copy and paste a whole blockchain like it’s nothing more than overdue science homework.

Instead, the information relating to any specific blockchain is stored across hundreds of different databases, all independent. Each database holds a complete copy of the digital ledger and all the blockchains within it. This means that no one individual can change anything without consensus from the majority.

What can blockchain do?

In Leeds, if you’re a student and you’re hungry, it is likely you’d order some food. If you were lucky, you’d enjoy some of the finest deep fried cuisine that the north has to offer. If you were unlucky, you’d order from one of the many take-away restaurants with a 0 hygiene rating from the UK’s Food Standards Authority. As you were hunched over, stomach cramped and life sucking, you might consider for a moment how on earth this could happen and what might be done to fix it.

This is one area where blockchain could help. In Victoria, British Colombia, the government set out to save stoned students everywhere by using blockchain. The idea was that each owner of a restaurant would have a passport that anyone would be able to view. It would contain an entire history of the owner’s assessments and inspections, all stored via Blockchain – things like hygiene ratings, infractions and accreditations could all be stored on this passport which would give credibility to restaurants and mean that punters could make sure they knew the performance and background of the owners whose restaurants they were frequenting.

This is an example of how the blockchain, and the immutability of the information it holds, can be used in real life situations beyond the bars and graphs of cryptocurrency exchanges.

Although interesting, such applications remain fairly niche. One of the more common applications you may have encountered is known as an NFT or Non-Fungible Token. These use Blockchain technology much like a receipt that will track the creation and ownership of digital content (or physical assets in some cases) throughout their entire history of owners – the idea being that, while one may have a copy of a particular album or artwork, the NFT can define who actually owns it.

This carries some potential, especially as the world of art increasingly shifts towards digital media. As we shall see later, this is a technological leap that is exciting those who follow crypto technology – especially those with a view to hold a stake in the next big crypto boom. There are some criticisms of the NFT, most notably that the information is only good so long as the information has context. There is no point in being able to track the owners of an asset if half of the owners have forgotten their passwords or have disappeared from the annals of history. In this sense, and especially when associated with physical items, there is little difference between a digital NFT and a paper receipt. Eventually they could get lost. Ownership does not guarantee possession. Not only that, but when one factors in the environmental impact of crypto technology, paper receipts might be better for the planet too.

Despite the potential for its application in saving students from dysentery and making sure that artists get fair dues for their work, by far the most common and well known usage of blockchain is Cryptocurrency. This is a new age currency that exists exclusively on blockchain. They act a little bit like stocks and shares, where the number of coins held, bought and sold dictates their value. Just like stocks, there are different people looking for different things in their cryptocurrencies. I’ve included a brief and unserious bio of my favourites below:

The crypto crowds

There are elite, casuals and chancers in each of these cohorts and this list isn’t exhaustive or meant to be take too seriously:

- The Holders

Some people place value in a crypto currency based on its technological merit; how fast are the transactions? How much does a transaction cost? What applications are there for the underlying blockchain?

One of the most popular cryptocurrencies is Ethereum. However, it’s notoriously slow and expensive to transact with. More modern cryptocurrencies offer incredibly fast transaction speeds and low fees. Others are vying to become the primary technology controlling NFTs or non-fungible tokens we discussed above.

The holders hope to be early adopters, investing in the technology that will eventually become popular and be picked up by a large organisation; or even an important nation state. The idea being that as soon as this happens, the value of the currency will sky rocket as the technology is deployed en masse.

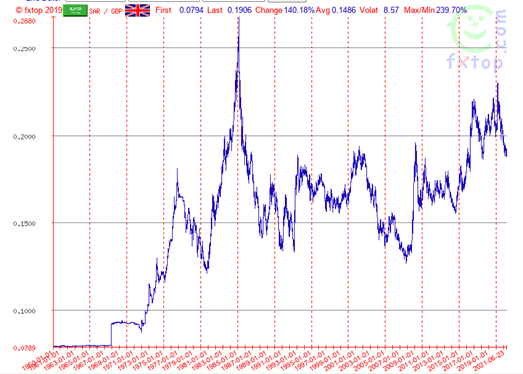

Something similar has happened in the past and had an incredible impact on some of the coins you probably have stashed in a loose change jar somewhere. The value of the traditional or “fiat” currencies that relied on oil exports spiked during the winter of 1973. Known in the UK as the winter of discontent, in 1973, the OPEC countries shifted the balance of power in the world sharply away from the rotting industrial age empires of England, France and Germany. They tripled the price of oil overnight. The impact for OPEC was astounding and the value of their currency increased exponentially almost immediately, and in many cases has been incredibly high ever since. Anyone holding a reserve of Saudi Riyal in 1971 would have been a very happy chappie.

This is the kind of event that the Holders would love to capitalise on.

Chart showing the massive spike in the Saudi Riyal, a traditional or “fiat” currency following the price hike of oil in 1973. This trend is replicated across the Qatar Riyal, the Kuwaiti Dinar and the UAE Dirham.

- The Day Traders

Some people see value in the volatility of crypto currency. These people bet lots of money on the movements of specific cryptocurrencies each day, week or month. In this sense, they are no different to those who trade stocks, commodities or futures in the same way.

If a particular cryptocurrency is going to be released on a new exchange (similar to an IPO in the stock market) or starts to be accepted or backed by a new company, then these are signals to buy. These people will try to game the system and make money from the highs and lows on every given day.

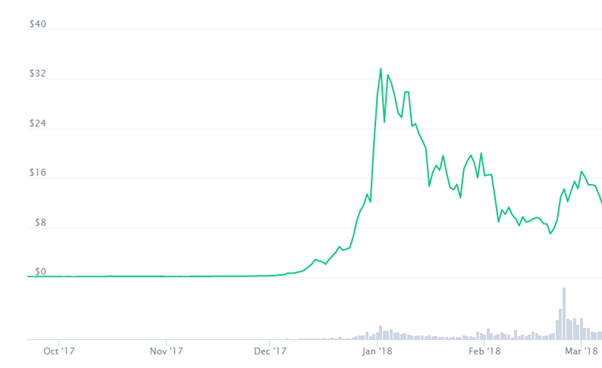

Naturally this is a high risk strategy, but there are some insane stories of crypto currencies appreciating 300,000% in the space of a month. Stories like this perpetuate the idea that putting the £10 into the right coin at the right time could make you a millionaire. These people dream of a margarita infused infinity pool, except they want it tomorrow and are prepared to lose some life savings to get it. And with crypto being so early in its lifecycle, there’s a likelihood that someone will get lucky. In fact, some people already have.

A snippet of the chart showing Nano’s stratospheric rise from the equivalent of £0.005p in March 2017 to £27.67, only 10 months later.

- The shit coiners

Shit coins refer to a branch of coins that have no technological value whatsoever. Their only purpose is to ride the waves of popularity and jump on early hype and/or the whims of Reddit. Much like the day traders, the fun here is jumping on a coin with a ridiculous name and a hilarious logo before it hits the forums and becomes huge. There are other reasons that one may wish to invest in a shit coin. In some cases, entities like football clubs and e-sports teams may release their own tokens. These tend to appreciate and depreciate in value depending on how the team performs.

Occasionally, the makers of some of these coins will shift the messaging and reason to invest in a short space of time. Typically this happens in response to a downward trend. The coin Smegmars for example, changed it’s mission statement from wanting to “put the first dicks in Space” to beating testicular cancer following a dramatic crater. While an honourable cause in principle, the very nature of crypto currency means that the accountability for coins like this is limited. For those wishing to give to charity, there are likely more transparent and accountable ways to do so.

Shit coins can have a variety of successes, but the best thing about them is usually the ingenious things people call them. Some classics have been around a while, favourites like Dogecoin and the Shiba Inu Coin. Others, such as Smegmars, are brand new and oscillate in value like the strings on a guitar (currently $0.00005 at the time of writing). People who invest in these coins are more like the day traders but tend to play with pocket change rather than life savings. Their decisions are based more on taste and hype than analysis. Plus a sense of humour.

The Shiba Inu, Dogecoin and Smegmars Logos

This is part 1 of a series looking at the rise of crypto currency technology for beginners.